Starting with Lafayette TN insurance, this comprehensive guide covers the various types of insurance available, the top providers, mandatory requirements, and factors affecting costs.

Delve into the world of insurance in Lafayette, TN and discover everything you need to know to make informed decisions.

Types of Insurance in Lafayette, TN: Lafayette Tn Insurance

Health Insurance:

Health insurance in Lafayette, TN provides coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. It ensures that individuals have access to necessary healthcare services without facing significant financial burdens.

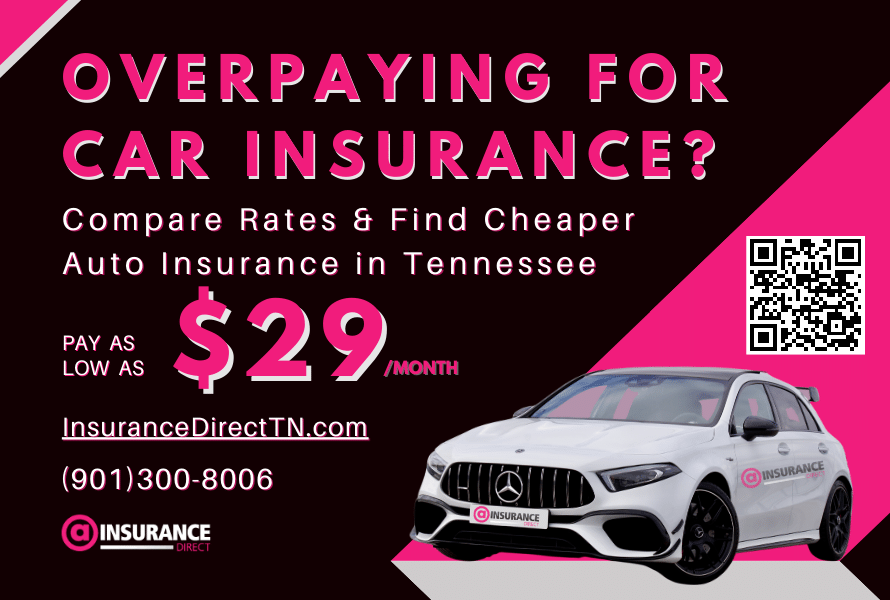

Auto Insurance:

Auto insurance in Lafayette, TN offers protection against financial losses resulting from car accidents, theft, or damage to the vehicle. It covers repair costs, medical expenses, and liability claims in case of an accident.

Home Insurance:

Home insurance in Lafayette, TN safeguards homeowners against losses due to theft, natural disasters, or property damage. It provides coverage for the structure of the home, personal belongings, and liability protection in case someone is injured on the property.

Life Insurance:

Life insurance in Lafayette, TN offers financial protection to beneficiaries in the event of the policyholder’s death. It can help cover funeral expenses, replace lost income, pay off debts, and secure the financial future of loved ones.

Insurance Providers in Lafayette, TN

1. State Farm Insurance:

State Farm is a well-known insurance provider in Lafayette, TN, offering a range of insurance products, including auto, home, and life insurance. Customers appreciate the company’s personalized service and competitive rates.

2. Allstate Insurance:

Allstate is another reputable insurance company operating in Lafayette, TN, known for its comprehensive coverage options and strong customer support. Policyholders value the company’s claims handling process and financial stability.

3. Farmers Insurance:

Farmers Insurance provides various insurance solutions in Lafayette, TN, such as auto, home, and business insurance. Clients praise the company’s responsive agents and flexible policy offerings.

Insurance Requirements in Lafayette, TN, Lafayette tn insurance

Residents of Lafayette, TN are required to have auto insurance to legally operate a vehicle on the road. Failure to meet this insurance requirement can result in fines, license suspension, or vehicle impoundment. It is essential for residents to maintain the minimum liability coverage to comply with state laws.

Cost Factors for Insurance in Lafayette, TN

Insurance costs in Lafayette, TN are influenced by factors such as age, driving record, credit score, and the coverage amount selected. Residents can lower their insurance premiums by bundling policies, maintaining a clean driving record, and improving their credit score. Different demographics may have varying insurance costs based on these factors.

End of Discussion

Explore the diverse landscape of insurance options in Lafayette, TN and find the right coverage that suits your needs and budget. Make informed choices for a secure future.

FAQ Guide

What are the mandatory insurance requirements in Lafayette, TN?

In Lafayette, TN, residents are required to have auto insurance to legally drive on the roads. This insurance must meet the state’s minimum coverage limits.

How can residents lower their insurance premiums in Lafayette, TN?

Residents can consider bundling their insurance policies, maintaining a good credit score, and opting for higher deductibles to lower their premiums in Lafayette, TN.

Do different demographics have varying insurance costs in Lafayette, TN?

Yes, insurance costs can vary based on factors like age, gender, driving record, and location in Lafayette, TN. Younger drivers or individuals with poor driving histories may face higher premiums.