Cheap best auto insurance is a crucial aspect of financial planning for vehicle owners, offering a balance between cost and quality coverage. In this guide, we explore key considerations, strategies, misconceptions, and fine print details to help you navigate the world of auto insurance effectively.

Factors to Consider When Looking for Cheap Best Auto Insurance

When searching for affordable auto insurance, there are several key factors to keep in mind to ensure you get the best coverage for your needs at a reasonable price.

Importance of Coverage Limits

It is crucial to understand the coverage limits of your policy, as they determine the maximum amount your insurance company will pay out for a claim. Higher coverage limits typically result in higher premiums but provide better protection in case of an accident.

Role of Deductibles in Determining Premiums

Deductibles are the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums, but it also means you’ll have to pay more in the event of a claim.

Impact of Driving Record on Insurance Costs

Your driving record plays a significant role in determining your insurance costs. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or tickets may result in higher rates.

Type of Vehicle Affecting Insurance Rates, Cheap best auto insurance

The type of vehicle you drive can also impact your insurance rates. Sports cars and luxury vehicles typically cost more to insure due to their higher repair costs and increased risk of theft.

Strategies to Obtain Affordable Auto Insurance: Cheap Best Auto Insurance

To secure affordable auto insurance, consider implementing the following strategies to save money and find the best coverage options.

Tips for Bundling Policies

Bundling your auto insurance with other policies, such as home or renters insurance, can often lead to discounted rates from insurance companies.

Benefits of Maintaining a Good Credit Score

Maintaining a good credit score can help lower your insurance premiums, as insurance companies often use credit information to assess risk and determine rates.

Driving Less for Lower Premiums

Driving fewer miles each year can qualify you for lower premiums, as you are considered less at risk for accidents if you spend less time on the road.

Discounts for Safe Driving Habits

Insurance companies offer various discounts for safe driving habits, such as completing defensive driving courses, installing safety features in your vehicle, or using telematics devices.

Common Misconceptions About Cheap Auto Insurance

It’s essential to debunk common misconceptions about cheap auto insurance to make informed decisions when selecting a policy that meets your needs and budget.

Myth of Lower Coverage with Cheaper Insurance

Contrary to popular belief, cheaper insurance doesn’t always mean less coverage. It’s important to review policy details and compare quotes to ensure you’re getting adequate coverage at an affordable price.

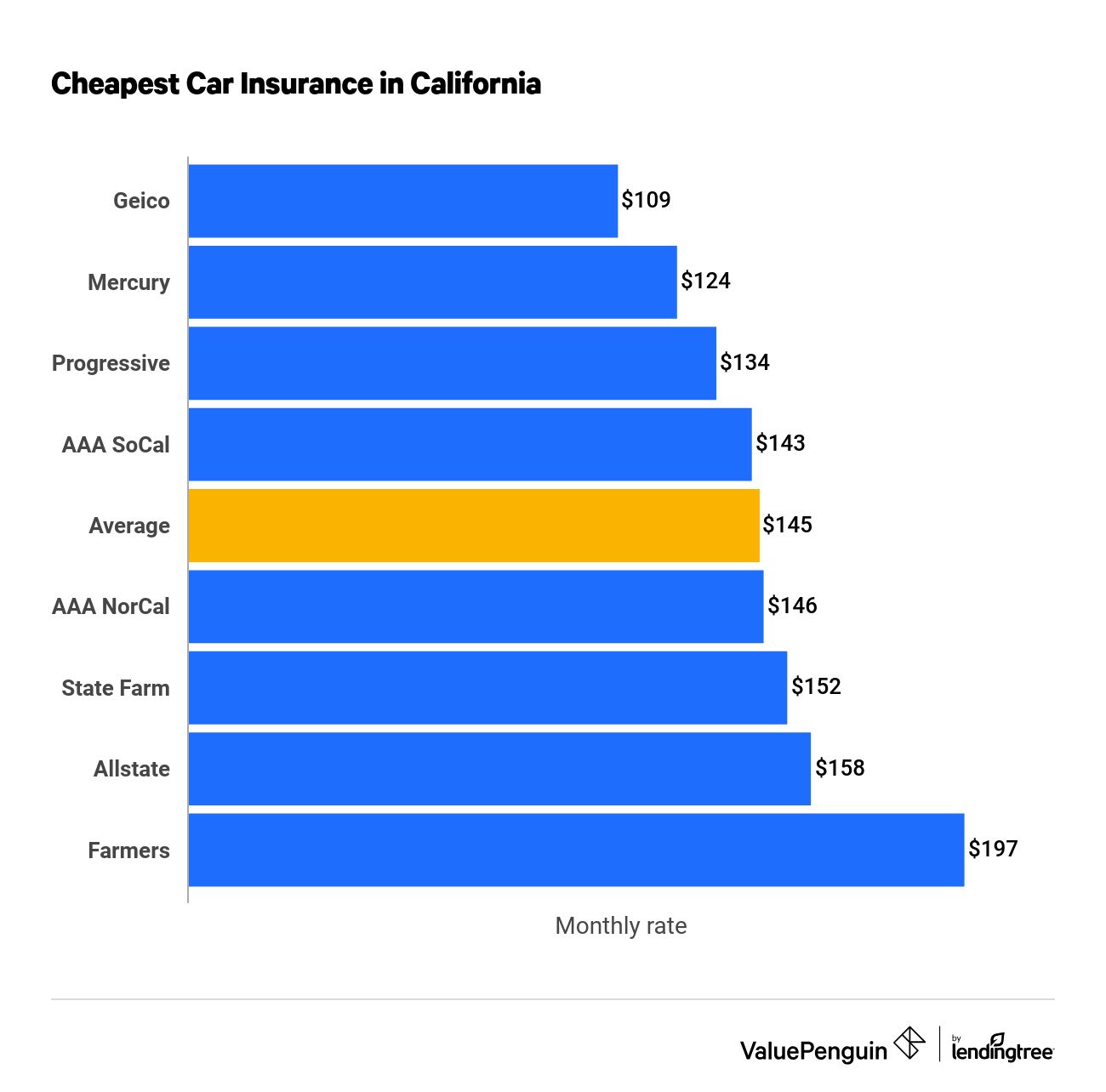

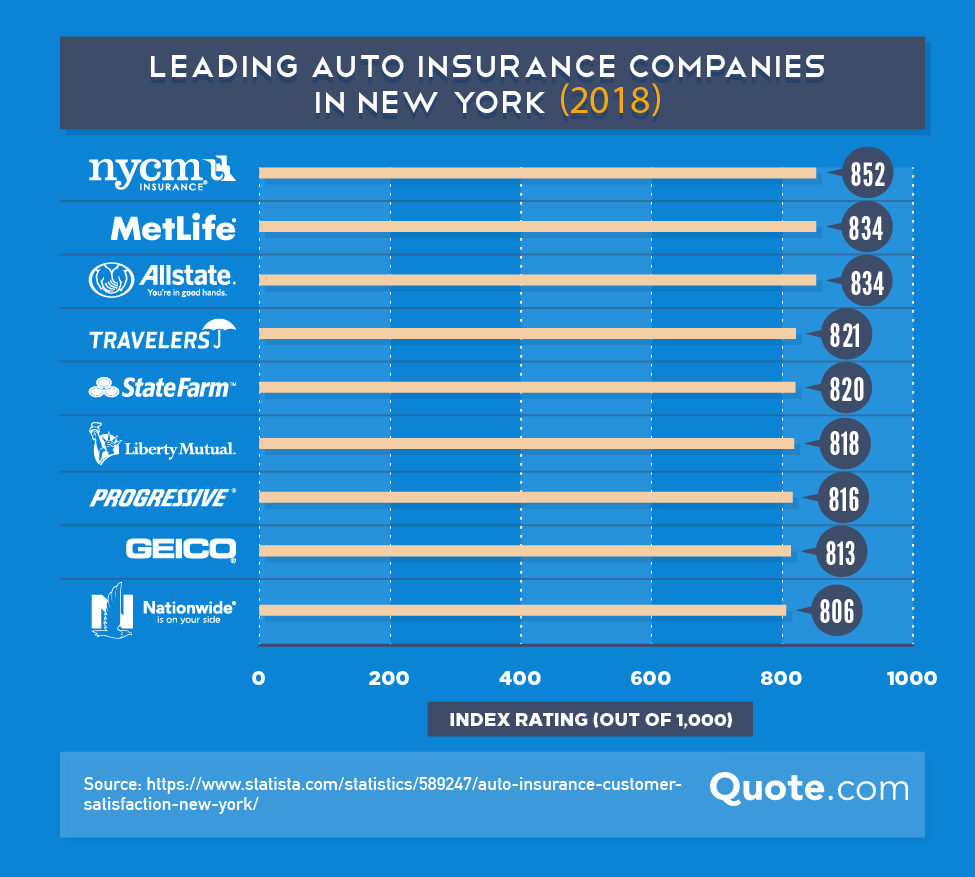

Importance of Comparing Quotes

Comparing quotes from multiple insurers is crucial to finding affordable options. Each insurance company offers different rates and coverage options, so it’s essential to shop around.

Reviewing Policy Details to Avoid Hidden Costs

To avoid surprises, carefully review the details of your policy to understand any hidden costs or exclusions that may impact your coverage or premiums.

Switching Insurers for Savings

While switching insurers can sometimes lead to savings, it’s not always guaranteed. Consider factors beyond price, such as customer service, coverage options, and reputation when evaluating new insurance providers.

Understanding the Fine Print of Cheap Auto Insurance Policies

Reading and understanding the fine print of your auto insurance policy is crucial to ensure you have the coverage you need when you need it.

Interpreting Insurance Terms and Conditions

Take the time to understand insurance terms and conditions to avoid any confusion or misunderstandings about your policy coverage and limitations.

Significance of Coverage Exclusions

Know what your policy does and does not cover by reviewing coverage exclusions. Understanding these exclusions can help you avoid surprises in case of a claim.

Add-On Coverages for Additional Protection

Consider adding optional coverages to your policy, such as rental car reimbursement or roadside assistance, to enhance your protection and peace of mind.

Filing a Claim and Impact on Future Premiums

Understand the process of filing a claim with your insurance company and how it can impact your future premiums. A history of claims may lead to higher rates in the long run.

End of Discussion

Navigating the realm of auto insurance can be complex, but armed with the right knowledge and insights provided in this guide, you can make informed decisions to secure the best and most cost-effective coverage for your needs.

Commonly Asked Questions

Is cheaper insurance always less reliable?

Not necessarily. It’s essential to compare coverage options and choose a reputable insurer offering affordable rates.

How can maintaining a good credit score impact insurance costs?

A good credit score can lead to lower premiums as it reflects financial responsibility, making you less risky to insure.

Are there discounts available for safe driving habits?

Yes, many insurers offer discounts for safe driving practices such as avoiding accidents and maintaining a clean driving record.